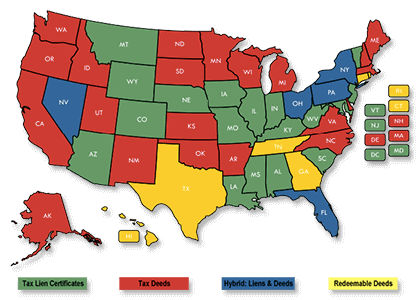

Tax Deed States Map

Tax Deed States Map – 13. (tie) New York Average effective property tax: 1.38% 2022 average home value: $370,445 Average annual property tax paid: $5,112 New York ties with Michigan for states with highest property . Jim Elliott writes, No, Mr. Cotton, the root cause of taxation is the need to pay for services that the public demands their governments provide as expressed by their approval or disapproval of .

Tax Deed States Map

Source : www.proplogix.com

Tax Deed States with Real Life Case Studies Tax Sale Resources

Source : www.taxsaleresources.com

Revisit Tax Deeds As a Source of Real Estate WSJ

Source : www.wsj.com

Tax Lien Facts | US Tax Lien Association

Source : ustaxlienassociation.com

Tax Lien Education | Facebook

Source : m.facebook.com

Ted Thomas Complete List of Tax Deed States

Source : tedthomas.com

Tax Liens Lead to Homeowner Foreclosure

Source : www.aarp.org

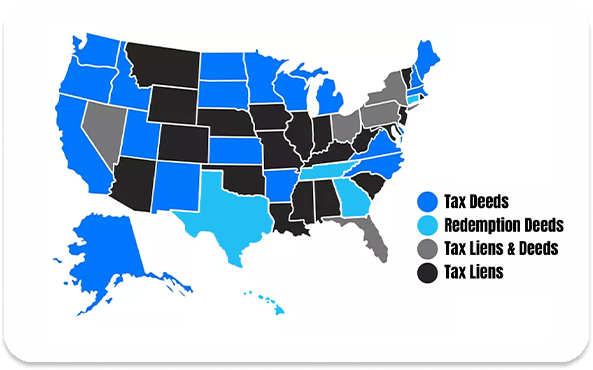

Tax Sale Map

Source : www.taxsalesupport.com

Index of /portals/0/images/naso

Source : www.naso.org

Introduction to Tax Lien Investing Webinar YouTube

Source : www.youtube.com

Tax Deed States Map Tax Lien Certificates vs. Tax Deeds: What’s the Difference : but so are things like sales and property taxes. It’s important for them to understand the tax implications of living in a state before deciding where to retire. Bankrate notes that retirees may . The purple represents, as the legend indicates, property tax rates between 2.9 and 4.2 percent. The homes and businesses in this area owe, every year, between 2.9 and 4.2 percent of the value of their .