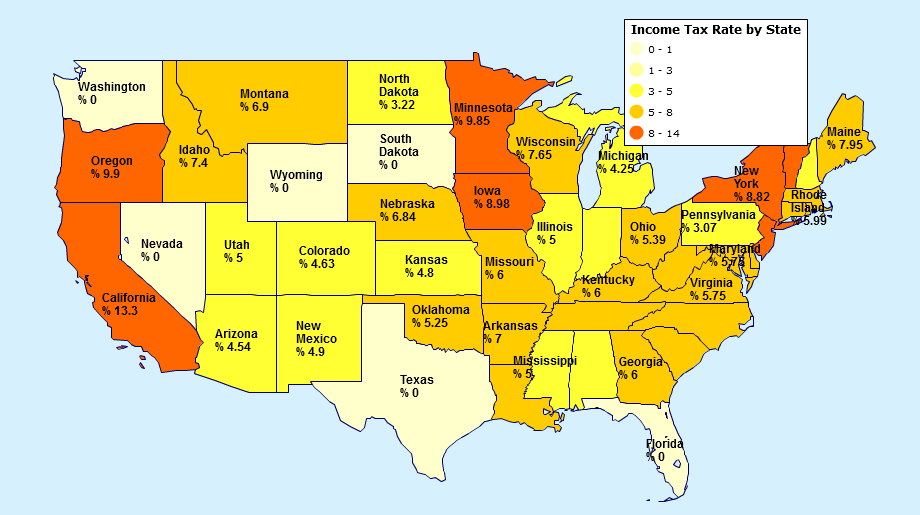

Income Tax Rate By State Map

Income Tax Rate By State Map – Taxes may seem confusing, but they don’t have to be. We’re almost in the monthslong period when the Internal Revenue Service is accepting tax returns, and it’s essential to understand . See the gallery for the 13 states that do not tax retirement income. State and local tax rates come from Tax Foundation’s mid-year report. Illinois charges a flat state income tax, but exempts .

Income Tax Rate By State Map

Source : taxfoundation.org

State income tax Wikipedia

Source : en.wikipedia.org

State Income Tax Rates and Brackets, 2021 | Tax Foundation

Source : taxfoundation.org

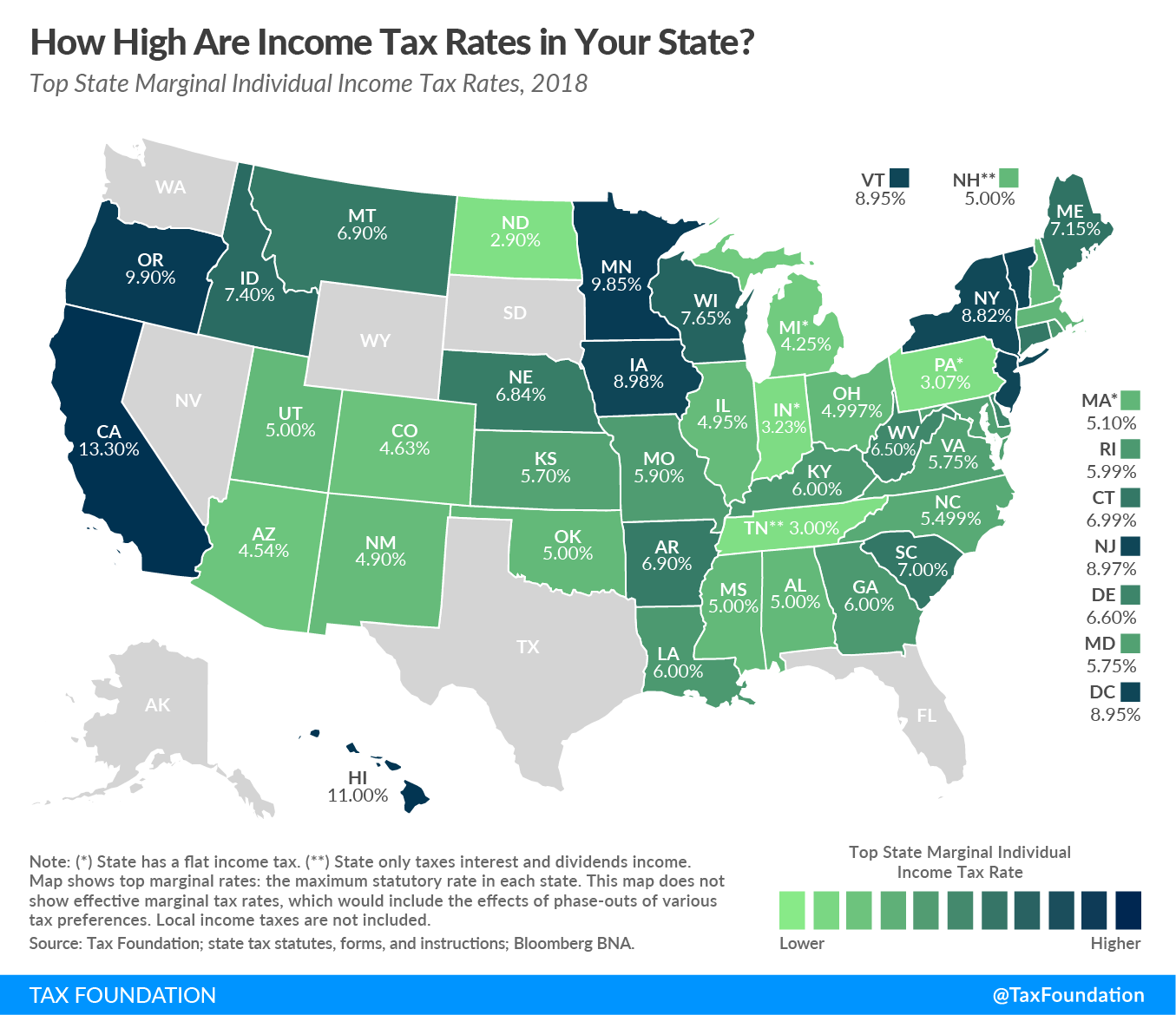

State Individual Income Tax Rates and Brackets for 2018

Source : taxfoundation.org

2023 State Income Tax Rates and Brackets | Tax Foundation

Source : taxfoundation.org

Top State Income Tax Rate Map | MapBusinessOnline

Source : www.mapbusinessonline.com

Monday Map: Top State Income Tax Rates, 2013

Source : taxfoundation.org

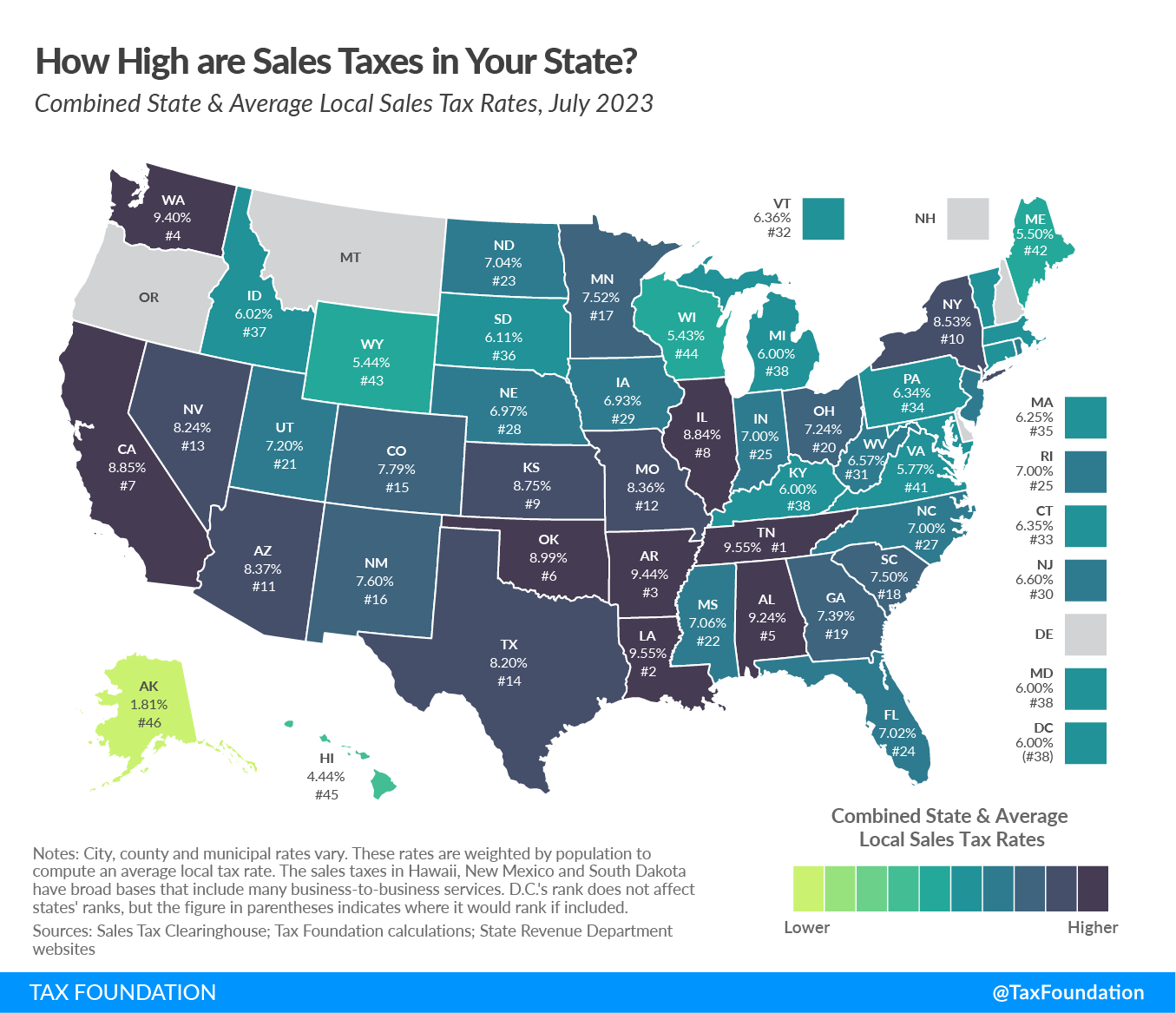

State and Local Sales Tax Rates, Midyear 2023

Source : taxfoundation.org

Monday Map: Top State Marginal Income Tax Rates, as of January 1st

Source : taxfoundation.org

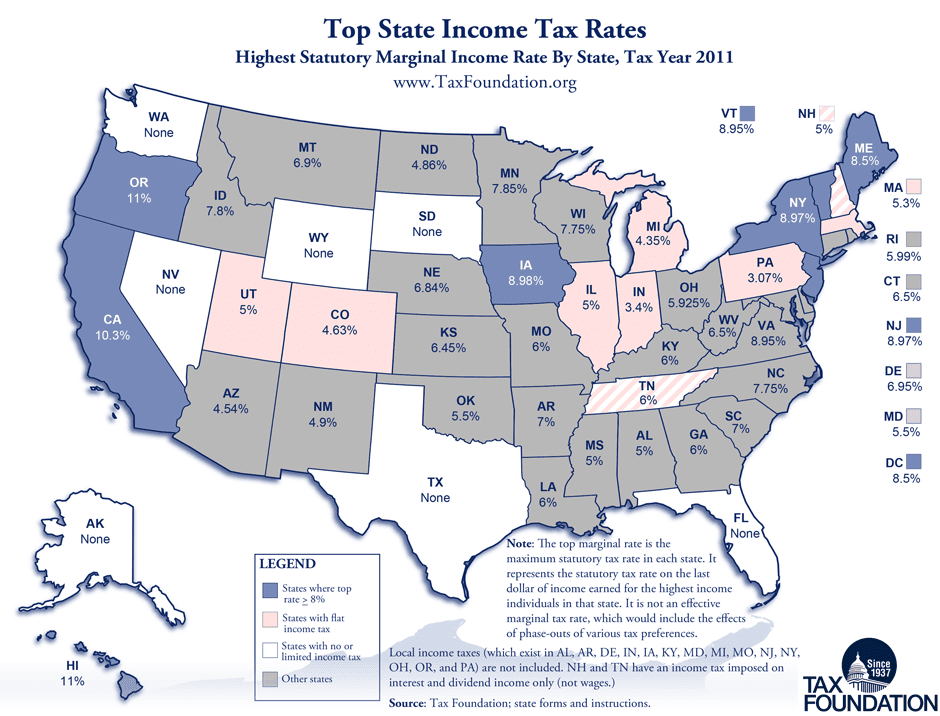

CARPE DIEM: Monday Map: State Income Tax Rates

Source : mjperry.blogspot.com

Income Tax Rate By State Map Monday Map: Top State Income Tax Rates: Florida does not have a state income tax, while California does. However, both states have property and sales taxes. While such taxes generally have a flat rate and can appear to affect all taxpayers . Sales tax statewide is 6.5%. In Lynnwood, Mukilteo and Mill Creek, it’s 10.6%. So where does that extra revenue go? .